Yesterday at WWDC 2015, Apple announced a number of key developments related to Apple Pay. The highlights at a high level were:

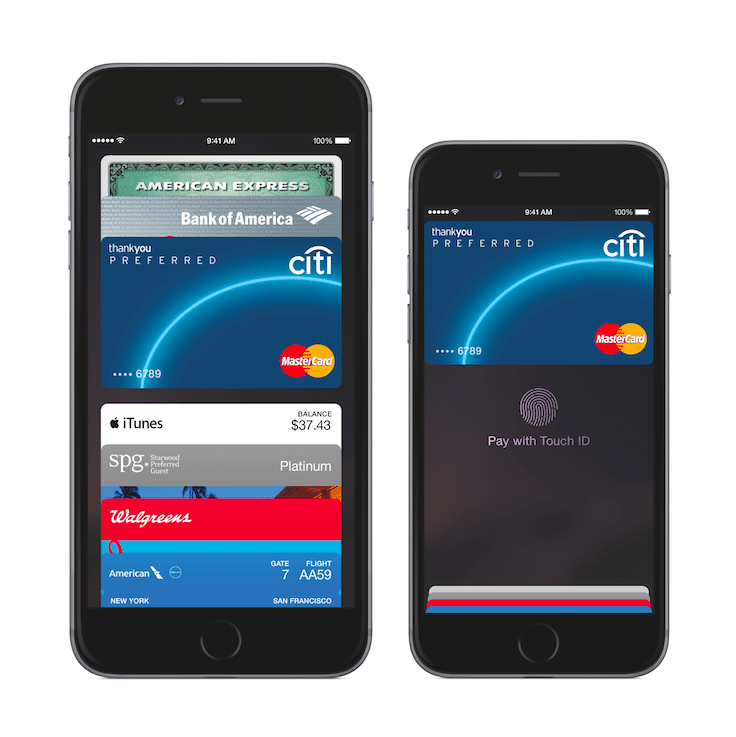

- Rebranding of “Passbook” to “Wallet”

- Apple Pay to be introduced to the UK in July

- Square launching a reader in the fall so small businesses can accept Apple Pay

- Apple is working with Pinterest to launch Buyable Pins, which allow users to buy from popular retailers with Apple Pay

- The introduction of a loyalty system that allows inclusion of store cards for popular retailers like JC Penney, Kohls, Walgreens, and Dunkin’ Donuts

Via Apple Press Info

Of these developments, loyalty integration is a perhaps the most important. According to an Apple Press release issued yesterday

“Apple Pay™ is making everyday payments even better by adding support for rewards programs and store-issued credit and debit cards with iOS 9. Apple Pay will also give shoppers more ways to pay in the US, expanding merchant acceptance to over one million locations next month and bringing support for Discover this fall. With this addition, Apple Pay will accept credit and debit cards across all major card networks, issued by the most popular banks, representing 98 percent of all credit card purchase volume in the US.”

In much of the commentary surrounding Apple Pay, the lack of loyalty integration was noted as a major flaw, particularly because it didn’t offer much incentive to merchants with strong loyalty programs. Now, the Wallet app will allow customers to add rewards and store-issued cards and use them with Apple Pay, which benefits both the retailers and the users. And while the initial list of retailers on board may not be extensive, Apple has stated that many more will be added in the near future.

Has Apple Won The Mobile Payments Battle?

While the move to include loyalty programs is a smart play by Apple, not everyone is on board. A survey conducted by Reuters found that 28% of retailers cite a lack of access to customer data as a barrier to acceptance, and with 18 of the largest retailers committed to CurrentC – an Apple Pay competitor – there are some key players that won’t be supporting it anytime soon.

Furthermore, there’s no lack of competition in the space, with Android Pay and Samsung Pay both slated to roll out this year.

And of course, there will still be merchants that prefer the access to customer analytics and ownership of the merchant/customer process that branded closed loop systems allow.

Despite these challenges, it looks like Apple is geared to occupy a competitive position in the mobile payments space. The tech giant has been aggressively pursuing partnerships with retailers, and with the integration of rewards and store-issued cards now a possibility, we’re likely to see many others added to the list.