We all understand the pains of new technologies at initial launch. Every development company must learn the ins-and-outs of how a new technology works and how to implement it into the corresponding environment. Apple Pay is no different.

What Do I Need Before Integrating Apple Pay?

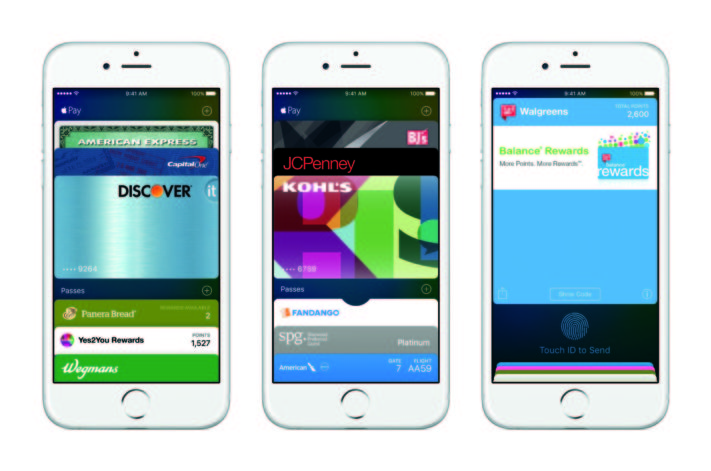

Via Apple Press Info

When working with Apple Pay from a development standpoint, there are a couple of elements to keep in mind before the integration phase.

To begin, setting up an account with a payment processor/gateway is vital. In order for payments to go through there has to be some way of processing those payments. Sometimes a payment processor/gateway already exists because of previous payment methods, but this step needs to be taken either way.

Second, Registering a Merchant Identifier via iTunes Connect in the Certificates, Identifiers & Profiles section and obtaining a Certificate Signing Request file for use in generating a certificate through Apple are both mandatory, and the latter will be used to encrypt and decrypt Payment Tokens for Apple Pay. Every app developed for iOS needs an identifier and a certificate attached to it, but this newly generated certificate will pertain to Apple Pay and the encapsulated information stored within the tokens.

Lastly, in terms of mandatory steps to take before integrating Apple Pay, including an Apple Pay entitlement to the app grants additional permissions so the app can access certain resources or perform certain operations that are specific to Apple Pay.

Time to Start Developing

The PassKit framework adds support by providing the APIs for Apple Pay. PassKit handles the support for payment passes and payment requests. The APIs that the app consumes will determine if the app is running on a device that has been provisioned with payment cards that are supported from credit card issuers and banks.

- When your user selects goods or services to buy and selects Apple Pay as the payment method, you create a payment request and ask PassKit to present the payment sheet to the user.

- Your app specifies the contents of the payment sheet but it does not control the user’s interaction with the sheet. You must decide if it makes sense to present shipping and billing information, shipping method, and other line items to the user.

- Payment token

- Once authorized by the user with Touch ID, your app receives a payment token from PassKit. The payment token contains the information needed to complete a payment transaction. It includes a cryptogram, unique to the specific purchase, that can be decrypted with your private key or when the payment information is transmitted to a payment processor’s server that has your private key.

Which Payment Providers support this service?

- For a list of payment provider please visit https://developer.apple.com/apple-pay/

Which payment networks are supported?

- Visa, MasterCard, and American Express

Which card types are supported?

- Both credit and debit cards from the major issuing banks are supported.

How much does it cost to accept Apple Pay?

- Apple does not charge users, merchants or developers to use Apple Pay for payments. Your credit and debit transactions will continue to be handled by the payment networks.

Apple Pay’s Influence on Loyalty Programs

At most major retailers, a big part of customer engagement has become the creation of loyalty programs. Customers purchase products and have the option to either present their loyalty card or give some personal information to collect on future rewards. Mobile payments have the ability to remove the extra step it takes to collect on these loyalty programs.

Via Apple Press Info

Prior to the announcement that Apple Pay will offer the ability to integrate rewards programs, the lack of loyalty programs for this payment method was a major barrier to merchant adoption. This is because Apple keeps information private. According to the Apple Pay FAQ sheet, “Apple Pay retains anonymous transaction information such as approximate purchase amount. This information can’t be tied back to you and never includes what you are buying.” While this remains true for general Apple Pay transactions, those transactions done via a merchant rewards program operate on the rules of that rewards program, regardless of the payment being facilitated by Apple Pay. In other words, retailers get the same information they would if somebody was using a store rewards card.

While the integration of rewards is yet to roll-out on a wide scale, it does add an interesting element to mobile payments, essentially eliminating a major hurdle to merchant adoption of third-party digital wallets.

Apple Pay is here to stay and hundreds of thousands of apps will end up integrating the option as it becomes more popular. Whether you are a retailer, a restaurant, or an e-commerce shop, Apple Pay can make your app more user-friendly and help make the payment process simple. It is worth getting through the challenges of development for Apple Pay because, in the end, everyone wins.