“For content owners, the reality is that your audience is slowly moving away from you, evolving into one that demands your best content anywhere, on any device, and at any time.”

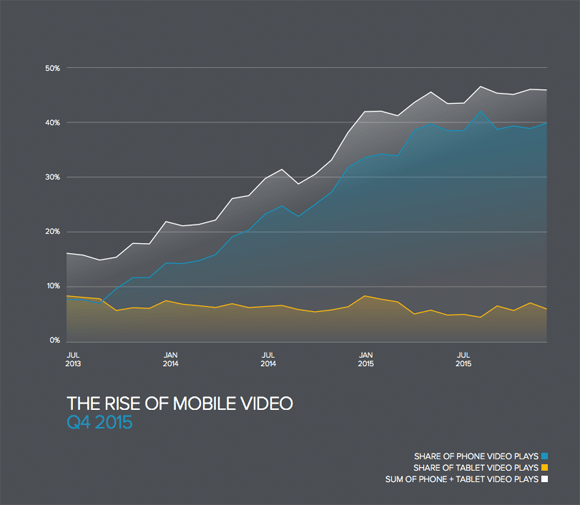

– Ooyala Global Video Index Q4 2015

While “cord-cutter” has been a common industry term ever since people started moving away from traditional cable, there is a similar yet unique group of content consumers that are potentially a far greater threat to media and content providers: cord-nevers.

The difference between the two is that content owners aren’t losing viewers as is the case with cord-cutters; they never had them in the first place.

The majority of cord-nevers are millennials; mobile natives who have never subscribed to cable and instead use online streaming services and OTT solutions to get their entertainment fix. And they’re driving a mobile video revolution.

A Mobile-First Mindset

Ooyala Global Video Index Q4 2015

Cord-nevers are a unique group in that their content consumption habits have developed with mobile a central part of the mix. They expect to have choice, to be able to find their entertainment on any device, at any time, and anywhere. Having content packages determined for them – for example, traditional cable subscription – has never and will never appeal to them.

Their expectations and behaviors are in line with broader shifts in the way content is distributed and consumed:

- 14% of US broadband households do not subscribe to pay TV, reflecting the growing shift towards viewing content via digital streaming

- Millennials are 67% more likely than average to be cord-cutters and 77% more likely than average to be cord-nevers

- Tablet and smartphone video plays grew 35% in the past two years and 170% since 2013

- Larger screens continue to get the lion’s share of video views for content over 10 minutes long, with that format making up 74% of all video watched on connected TVs

- Tablet use for content 10–30 minutes in length grew for the third consecutive quarter to 21%, the most of any device for content of that length, indicating that the devices remain a favorite of users watching episodic television

Sources: Ooyala – All About The Cord, Ooyala Global Video Index Q4 2015

Furthermore, Forrester predicts that by 2025, 50% of US adults under the age of 32 won’t pay for traditional cable subscriptions. Cord-nevers and cord-cutters will only continue to increase until they are the norm.

Why this change?

- The variety of options consumers have (SVOD, OTT, new devices, and platforms)

- The convenience to watch when, what, and where they want

- New content options and models available from premium services like Netflix and Hulu Plus

- Personalization – viewers are increasingly demanding services that learn their preferences and provide relevant recommendations

- Consumer ability to combine a mix of services and still pay less than traditional TV subscriptions

How Can You Appeal to Cord-Nevers?

One of the most valuable insights from the Global Video Index is the need for companies to focus on appealing to future audiences:

“You may be able to reach your audience of today – Gen Xers and Baby Boomers – via traditional media, but to reach your future customers, the buyers who will build your business, you need a mobile-first strategy that can be executed at scale.”

The majority of cord-nevers (mostly millennials) grew up in an era where illegally streaming content was the norm; now, this same audience is realizing the value of paying for high-quality, virus-free content from reputable services. For media companies and content owners, this is an opportunity to create new sources of revenue.

The question is, how?

Data

We’ve written in length about how metrics – Quality of Experience, Quality of Service, and Product/Business metrics – can be used to improve the overall customer experience. These same principles apply to attracting and retaining both cord-nevers and cord-cutters. Using data to understand your customers (how they are viewing content, what features they are using, their preferences) is imperative to offer the kind of personalized experiences consumers are seeking.

Value

Those who have cut the cord or have grown up without traditional pay TV realize that they can get the entertainment experiences they want from alternative sources and services – often at a lower price point. Yet, they also look for value from these alternatives. Quality of content, variety of content, user experience, etc., are all important factors in the decision-making process.

Content owners need to look at how they can add value with their existing products or via new products. What can you offer that the competition doesn’t? Is your pricing aligned with the marketplace? Does the experience you offer meet or exceed user expectations? Essentially, are you offering value that is not available elsewhere?

Flexibility

One of the most unappealing things about traditional pay TV is the lack of choice, from where and when you can view content, to what content you can access. Cord-nevers and cord-cutters are eschewing this model due to the number of alternatives available. With devices like Apple TV and Roku available, more TVE and OTT options entering the market, and services like Netflix and Hulu Plus continuing to emerge, choices will only increase. Cord-nevers love video, but they consume it when and where they want it.

As a content provider, appealing to this audience is about diversifying what you offer (and how you offer it). There is a lot of value placed on flexibility, so offering a variety of options – mobile, OTT, SVOD, TV Everywhere, etc. – is the best way to capture an increasingly cross-platform, multi-device audience.

While cord-cutting has been a top concern for media and content companies, cord-nevers may actually be a bigger threat to the established order. As they become more prevalent, the companies who win will be the ones that are able to understand the mobile-first mindset, offer personalization and flexibility, and provide the kind of content experiences this group values so highly.