Last Friday, we participated in a panel at the first York Region FinTech Summit. With panelists and speakers from PayPal Canada, OMERS Ventures, MaRS, Ernst & Young, RBC and more, the event brought together a wide range of different players and unique perspectives from across the FinTech and banking industries.

Despite the variety of experiences and industries, there were some trends regarding the present state and future of FinTech that the majority of speakers and panelists emphasized. These were the most important.

The Customer is Demanding Different Services

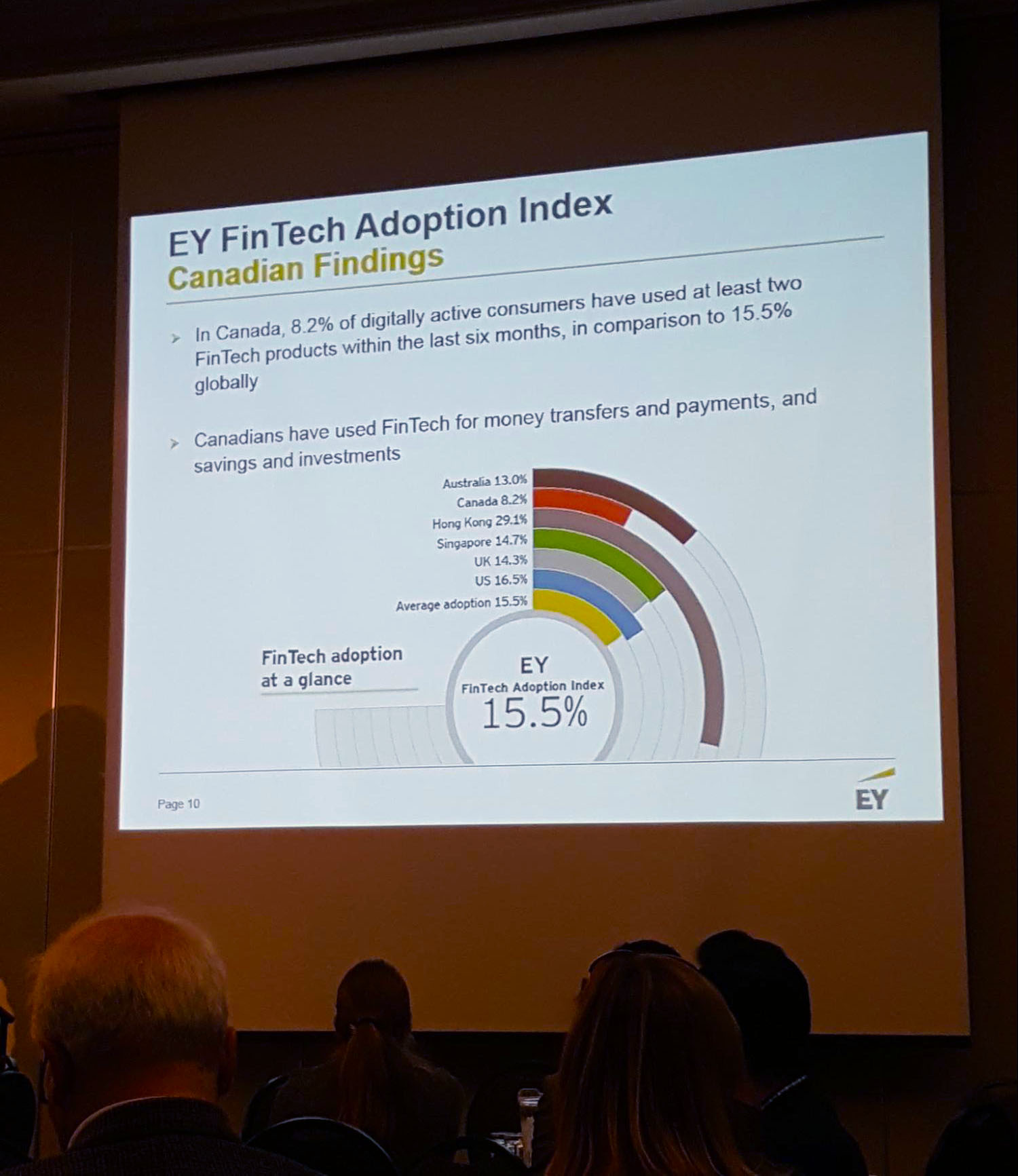

With all types of services that were traditionally offered in person or via desktop becoming available on mobile devices, consumers are expecting the same of financial services. Globally, FinTech product adoption has reached 15.5% among digitally active consumers. Canadian FinTech adoption lags behind at 8.2%, but is steadily on the rise (Source: Keynote Presentation by Tom Di Emanuale, Ernst & Young, York Region FinTech Summit).

Already, Canadians are using FinTech for money transfers and payments, savings, and investments. Other service offerings in lending, trading, and more are also being adopted as consumers demand more convenience and greater control over their finances.

Consumer Awareness is More of an Issue Than Consumer Trust

Consumer trust has often been cited as one of the most significant barriers to user adoption of FinTech services and products, but recent data presented by Ernst & Young suggests that it is less of an issue for both global and Canadian consumers than originally thought.

Despite the rising demand for FinTech products and services, respondents in the Ernst & Young FinTech Adoption Index who hadn’t used FinTech stated that lack of awareness was the reason, over a lack of trust:

- Was not aware it existed: 53.2% (Global), 57.2% (Canada)

- Do not trust it: 11.2% (Global), 10.3% (Canada)

While trust is still a barrier that needs attention, it seems that marketing and awareness building will be an area that requires investment to increase user adoption as new FinTech innovations become available.

User-Centric Design is and Will Continue to be Hugely Important

Virtually every speaker and panelist at the FinTech Summit – regardless of industry or job function – stressed the importance of user experience for the future of FinTech.

At the forefront of FinTech innovation are the concepts of convenience and value. Consumers seek an easy, seamless experience that offers them flexibility and addresses the pain points faced in their everyday lives. In order for FinTech services and products to be successful, they must be designed to solve specific user pain points.

That said, FinTech faces a big challenge concerning user experience: convenience and value must be balanced with data privacy and security. Given the sensitive nature of the information that FinTech handles, these concerns are more prominent than in many other industries. If innovation requires disrupting established processes, the disruption needs to happen without affecting the security of customer and organizational data.

Traditional Institutions and FinTech Innovators Will Compete and Collaborate

A common theme at the YR FinTech Summit was the simultaneity of both competition and collaboration between FinTech companies, and banks and other established financial institutions.

Many of the FinTech companies represented at the summit discussed the partnerships they had secured with banks and lenders; representatives from banks spoke in turn about the collaborative projects they are doing with FinTechs.

As we noted in a previous article on mobile banking, while FinTechs and banks are competing, partnership and collaboration will be necessary for innovation. This could involve investment in technology; formal partnerships; even acquisitions. Each party has assets that the other needs, whether it be the capital and clout of a large bank, or the agility and pace of a FinTech startup. We can expect to see a trend of collaborative competition as the space matures.

Ultimately, the rapid growth of FinTech innovators and the steps banks are taking to remain innovative in light of growing competition will continue to accelerate the FinTech industry in the near future. As the space is being negotiated, those who will see success will focus efforts on addressing consumer demand, trust, and awareness; creating products and services that focus on making the lives of end users easier and more convenient; and driving innovation through strategic collaborations.