When it comes to offering a mobile payment solution to customers, watching and waiting is no longer an option for businesses who hope to remain competitive.

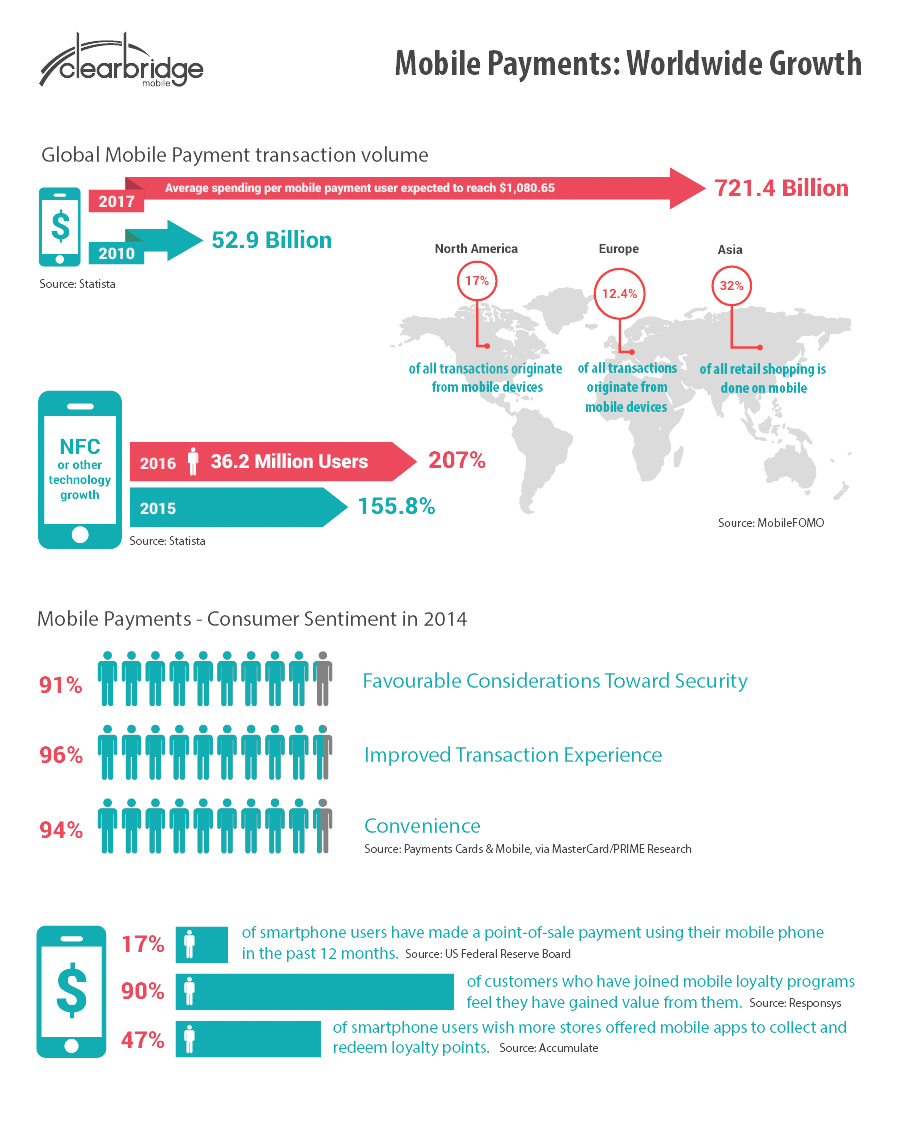

The market is primed for mobile payments. The number of smartphone users will surpass 2 billion in 2016, and with global mobile payment transaction volume forecasted to reach a staggering $721.4 billion by 2017, it is more important than ever that companies offer a mobile payment solution to capitalize on this trend.

And it’s not just a matter of offering ways for customers to pay online. There is increasing demand for mobile point-of-sale solutions, NFC and contactless mobile payment capabilities, and loyalty and rewards integration, all from a consumer’s mobile device. Furthermore, the sentiment is shifting, with consumers now talking positively about the convenience that mobile payments systems can provide and showing greater confidence in the safety and security of mobile payments.

The following infographic portrays why now is the perfect time to consider offering a mobile payment solution.